And unsurprisingly they are safety, speed and convenience. But what has also emerged is how shopping now encompasses a seamless interchange between bricks and clicks.

So, let’s take a look at what the survey found…

The survey

Conducted by Zebra Technologies the survey marks the 13th annual edition of the Shopper Vision Study and involved over 5000 shoppers, store associates and retail executives globally.

Its aim was to examine the attitudes, behaviours and expectations affecting both bricks and mortar and online retail.

The study found that while consumer’s motivations haven’t changed much in the wake of Covid, safety has become a priority.

“Shoppers still expect the items that they want to be readily available, at the best value with transactions that are a breeze,” the survey noted.

“However, many retailers are struggling to deliver on these expectations.”

Meanwhile, safety has become the priority as shoppers demand a blend of the offline and online experience.

An interchange between bricks and clicks

It’s little secret retail has now become an interchange between bricks and clicks, with online shopping becoming a mainstay of Coronavirus retail.

However, bricks and mortar retail remains critically important, especially when it comes to providing an omnichannel experience.

The report noted that means shoppers now harness both online and instore shopping, and their motivations for using each are similar.

They found when it came to ascertaining product availability:

• 54 per cent of shoppers looked instore

• 56 per cent searched online

In terms of product selection:

• 46 per cent looked instore

• 48 per cent searched online

And when it came to price comparison:

• 37 per cent looked instore

• 42 per cent searched online

“Shoppers are savvy and flexible,” the report stated.

“If they can’t get something instore, they’ll head online and vice versa, leveraging both channels for the most basic of reasons: product availability, selection, and price.”

The expectation gap

Zebra notes the crossover between online and instore means shoppers now expect safe, convenient and integrated experiences from retailers however and wherever they shop.

But while retailers might believe they’re delivering on that expectation, shoppers indicate there’s a disconnect.

In fact, while 90 per cent of retail executives believe shoppers are satisfied, only 76 per cent of consumers agree.

And the pain points include out of stocks and returns.

The report found the top three reasons a customer chose to leave a store include:

• Desired item is out of stock – 41 per cent

• Checkout line too long – 32 per cent

• Can’t find the item on display – 13 per cent

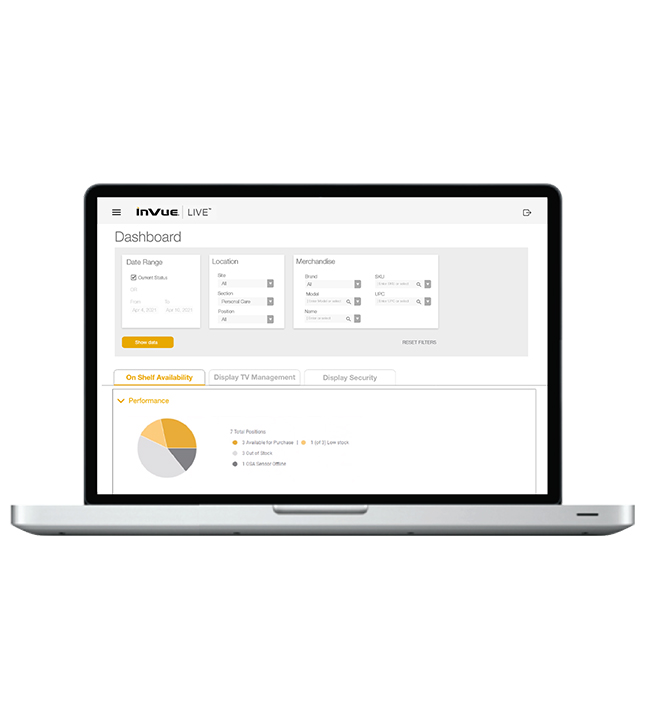

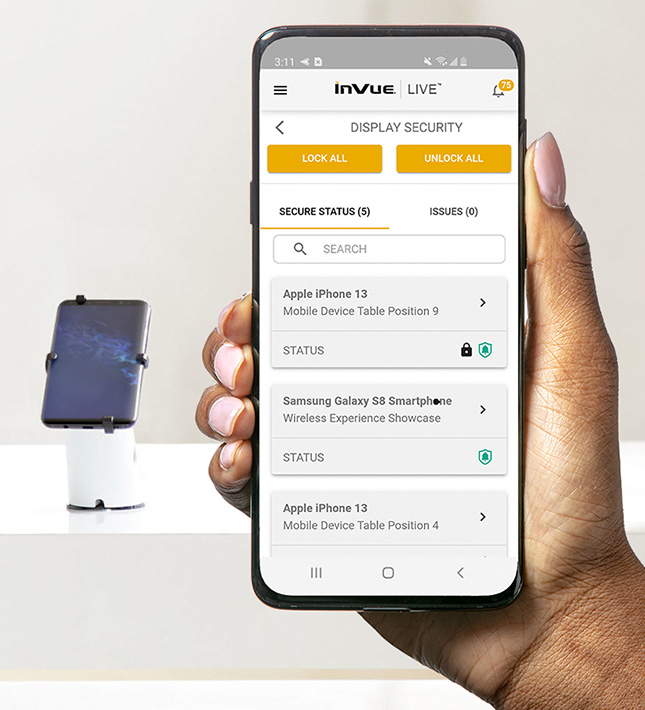

Technology now a mainstay in store

Over half (58 per cent) of all shoppers surveyed said they still preferred the in-store experience over shopping online, but their personal safety remains a priority.

Their primary physical retail concerns include:

• Surfaces that are not sanitized and social exposure – 67 per cent

• Long wait times to enter the store or at the checkout – 60 per cent

• Lack of self-checkouts or contactless checkouts – 54 per cent

• Lack of contactless payment methods – 50 per cent

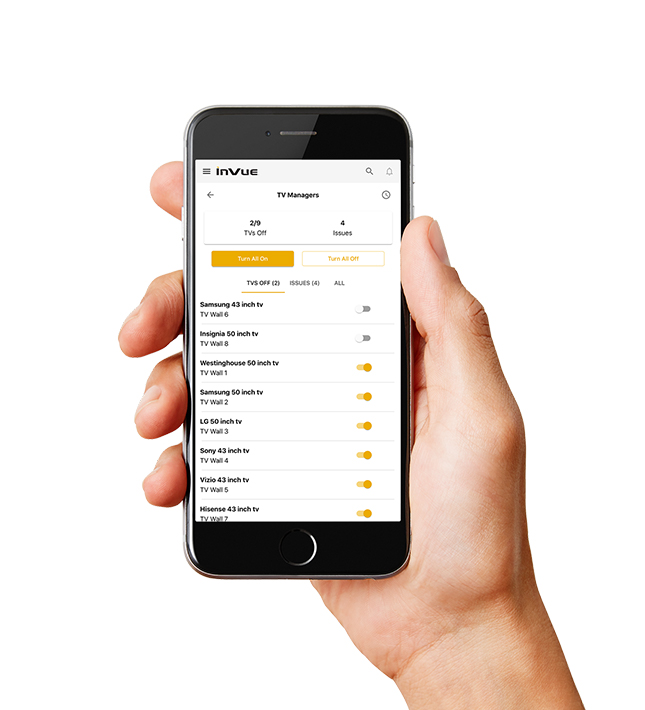

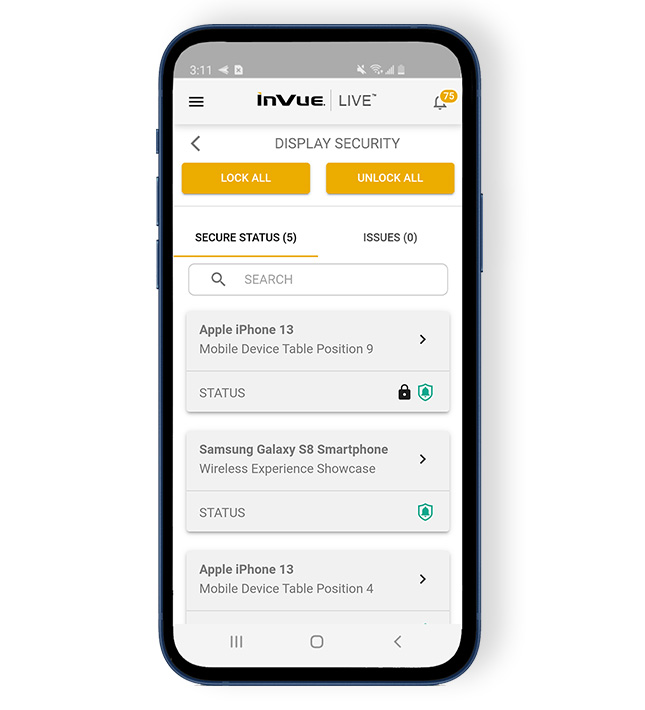

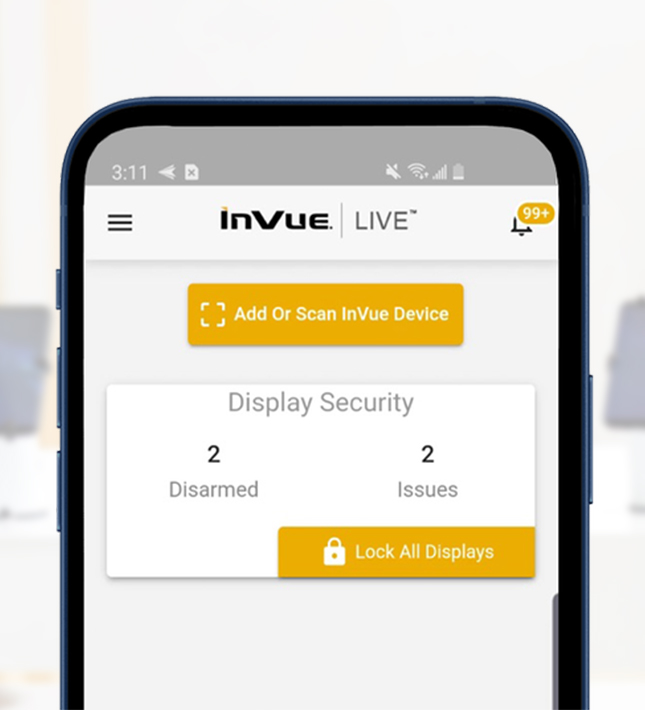

Meanwhile, 85 per cent of retail associates note technology allows them to provide a safer more streamlined customer experience.

They cite price checking (56 per cent) and inventory (52 per cent) as the most valuable uses of technology, while 61 per cent view their employer more positively for providing them with mobile devices and technology.

You can view our range of retail solutions that are designed to improve the instore experience here.