Initially, COVID-19 was widely predicted to have a devastating effect on many retailers. Instead, retail collapses hit record lows as government initiatives (such as JobKeeper and the temporary suspension of insolvent trading laws) protected retailers. Consumers hoarded cash and retailers pivoted to online, driving some to produce financial results way beyond expectations.

The Australian Retail Outlook 2021, co-produced with Inside Retail, offers retailers key insights into the year ahead. KPMG retail specialists delve into the key trends and forecasts included in the report.

The year of retailing bravely

It’s not all doom and gloom. The development of a COVID-19 vaccine provides a real reason for optimism, but it is important to understand that 2021 (and possibly beyond) will be all about the art of retailing against a lack of reasonable comparable sales while vaccine distribution ramps up and supply chains are reconfigured.

We believe that 2021 may be the year that challenges retailers even more as we cope with reduction of stimuli and return to some form of business as usual. COVID-19 has accelerated digital disruption and consumers are living, thinking and purchasing differently. Retailers are placing their bets around what will stick versus what has been a glitch.

The pressure on retailers to remain relevant in the eyes of the consumer has never been stronger. As the consumer’s preferred channel to purchase continues to shift, so too do the drivers influencing buying decisions and payment preferences as consumers demand greater personal safety and value for money.

“While the rapid shift to online caught many retailers unprepared, it has also seen businesses with strong digital DNA and e-commerce capabilities thrive, and their growth rapidly accelerate. After experiencing five years of e-commerce growth in a matter of months due to the pandemic, retailers and brands need to leapfrog their investment programs to deliver their 2025 plan today.” Matt Darby – Head of Retail, KPMG

“Retail rents will undoubtedly remain in the spotlight this year, as landlords and retailers continue their delicate dance to work together to achieve a win-win outcome and succeed in transitioning their respective operating models for the new reality. The new Payment Times Reporting Act commenced on 1 January 2021 and requires reporting entities to publicly report on their payment terms and times with small suppliers, which means that customers, suppliers, investors and, more importantly, the media, will have the ability to call out companies stretching their cashflow.” James Stewart – Joint National Leader, Restructuring Services, KPMG

Key highlights

Summarised below are four articles from the report where KPMG Australia retail specialists share their thoughts for the year ahead:

Consumers and the new reality

When toilet paper panic buying kicked in and many physical stores closed their doors, retailers knew that customers’ buying behaviour had drastically changed and that they would need to adapt.

Globally a different retail customer has emerged with new behaviours and decision-making criteria. There are four critical macro trends that have emerged from our research with retailers that are expected to share how considerations need to be made:

- economic impact

- erosion of trust

- rise of digital

- home is the new hub.

The article provides a deep dive into the research and unpacks the actions required by retailers to understand and respond to the changed consumer.

The future of retail operations

Understanding a few key trends can be the difference between a sustainable business model and a fleeting endeavour.

The fundamental shifts in consumer behaviour caused by COVID-19 have turbocharged the need for Australian omnichannel retailers to catch up to the rest of the world. Retailers need to understand and manage the profitability of these changes across all channels and ranges.

In this article we have focused on four key trends identified by Australian retailers in KPMG’s Global Retail Outlook survey.

- Business models and partnerships

- Declining margins and productivity – cost of doing business

- Purpose and reputation – sustainability and higher purpose

- Customer power

E-commerce is zooming

After experiencing five years of e-commerce growth in a matter of months due to the pandemic, retailers and brands need to leapfrog their investment programs to deliver their 2021 plan today.

We’ve seen extraordinary e-commerce growth as a result of the pandemic and Australian retailers have stepped up to the challenge by innovating at a speed we never realised was possible.

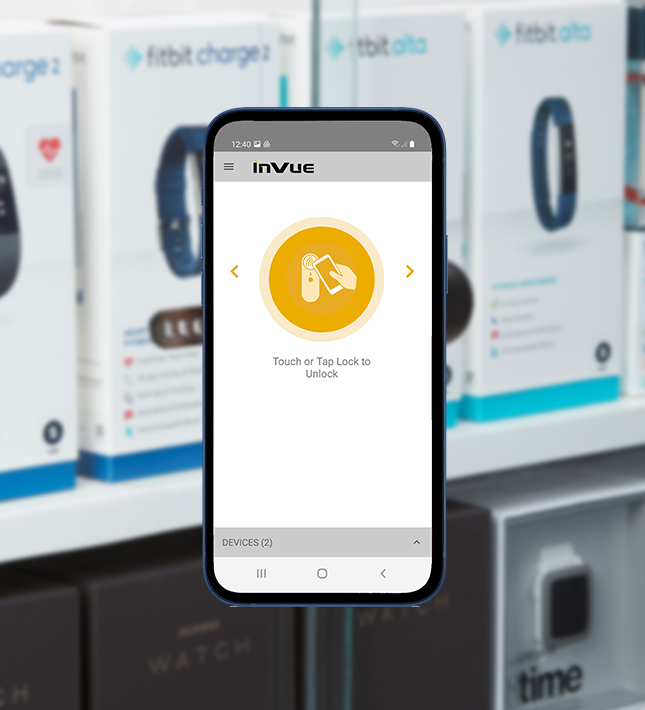

Lockdowns virtually transformed the role of online retail overnight. Digital and multi-channel experience investment cases all across Australia clicked over to ‘green light’ status. And now that we have re-opened consumers are doing as much as possible through digital and contactless channels, even when shopping in-store.

The three growing trends that fuse the digital and physical shopping experience include:

- click-and-collect

- same-day deliveries

- digital Payment.

The year of retailing bravely!

We believe 2021 will be the most unpredictable years we’ll have had for generations and will challenge many retailers who survived COVID-19. Retailers will be navigating an uncertain environment due to shifts in consumer behaviour and the winding back of support, which will place increased pressure on cash flow and working capital.

In theory, 2020 should have been a painful year for retailers. Instead, retail collapses hit record lows and the wave of insolvencies many predicted never occurred. What’s driving this?

The Government introduced four stimulus measures that supported retailers and softened the pain of the pandemic. We like to call these measures economic morphine.

Read the full article to find out what does this mean for retailers when the economic morphine is set to run off in the middle of the year.

Article sourced from KPMG