The Cyber Weekend tradition

Cyber Weekend is a shopping tradition that originated in the United States to tie in with Thanksgiving.

Over recent years it has gained popularity in Australia with consumers using the event to complete their pre-Christmas shopping list.

Australian Retailers Association (ARA) CEO Paul Zahra said the event contributed to Australia’s most significant shopping month of the year.

“For the past two years, November has beaten December as the biggest month for Australian retail sales throughout the year,” Mr Zahra said.

“Black Friday and Cyber Monday can be credited with this trend as people snap up some bargains and shop early for Christmas.

“We’re forecasting consumers to spend $5.4 billion over the four-day sales period. What began as an American shopping tradition has been embraced by Australians in a big way.”

Momentum heading into Christmas

Cyber Weekend is now considered part of the shopping momentum leading up to Christmas, with the ARA noting the Christmas quarter is the most critical of the year to retail.

For discretionary retailers, the period equates to up to two-thirds of annual profits, with Australians predicted to this year spend around $58.8 billion across November and December.

This predicted spending is on par with last year but an increase of 11.3 per cent on pre-pandemic conditions.

However, Mr Zahra also cautioned consumers that they would need to begin spending early this year due to global supply chain issues.

“With our supply chains under significant pressure, consumers need to be shopping early if they want their products to arrive in time for Christmas,” he said.

“There are several issues that retailers are navigating at the moment – everything from Covid impacts, shipping delays and threats of industrial action from port workers and delivery drivers.

“There’s a perfect storm of issues so consumers need to get in quick to ensure they get the products they want.”

What consumers will buy over Cyber Weekend

According to a survey by Finder, 46 per cent of Australians (or about 8.9 million people) are set to embrace sales like Black Friday and Cyber Monday in the lead-up to Christmas, spending $197 on average.

Although their estimations predict total Cyber Weekend spending of $3.8 million, their research also indicates spending will occur across a broad range of categories.

They note clothing/shoes top Aussie sales shopping list, with 42 per cent of survey respondents indicating they will purchase these items over the four-day sales period.

This is followed by:

- Food/alcohol – 33 per cent

- Electronics – 25 per cent

- Toys – 24 per cent

- Beauty/makeup/skincare – 16 per cent

- Manchester/homewares – 13 per cent

- Travel – 10 per cent

- Furniture – 7 per cent

- Whitegoods – 5 per cent

Interestingly, Finder notes men are likely to spend more than women, forking out $234 on average compared to $162 for women.

Meanwhile, Gen Y is expected to splash the most cash.

Breaking expenditure down by generation, Finder found:

- Millennials (Gen Y) intend to spend $287 on average

- Gen Z will spend $249 on average

- Gen X will spend $190

- The Baby Boomers will spend $65

How retailers can prepare

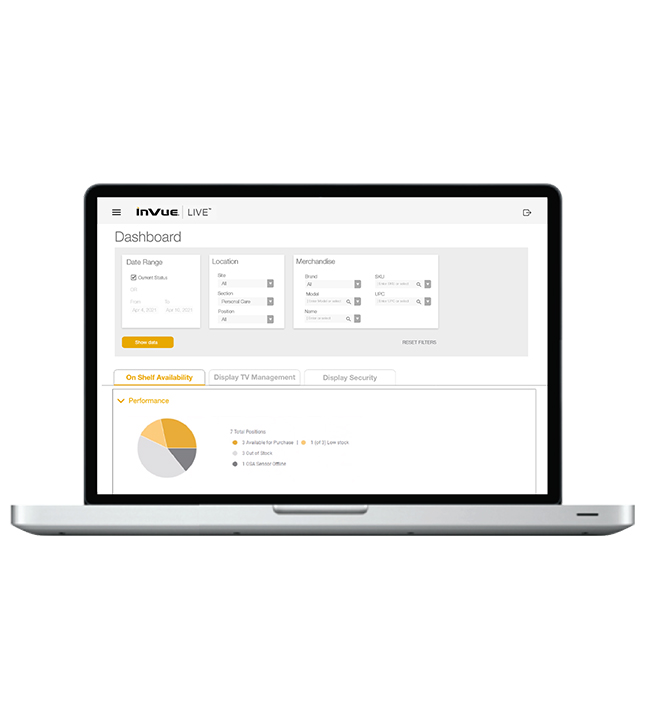

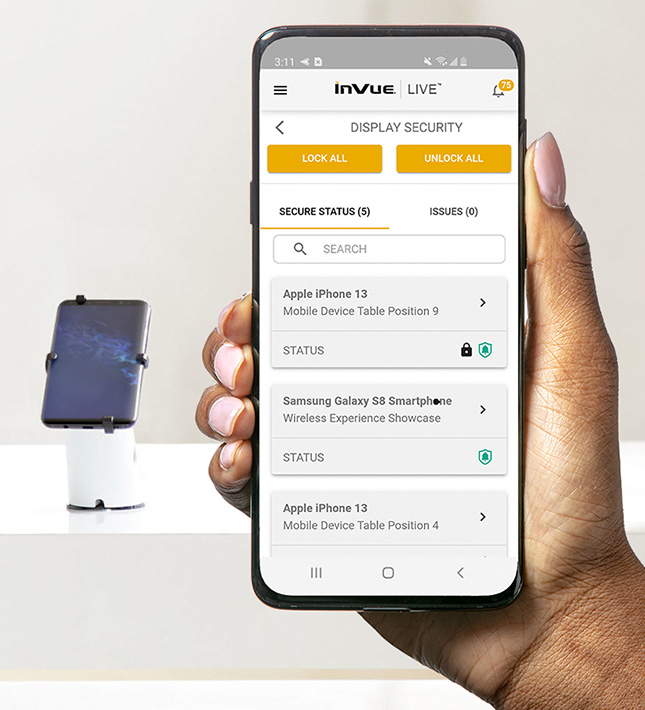

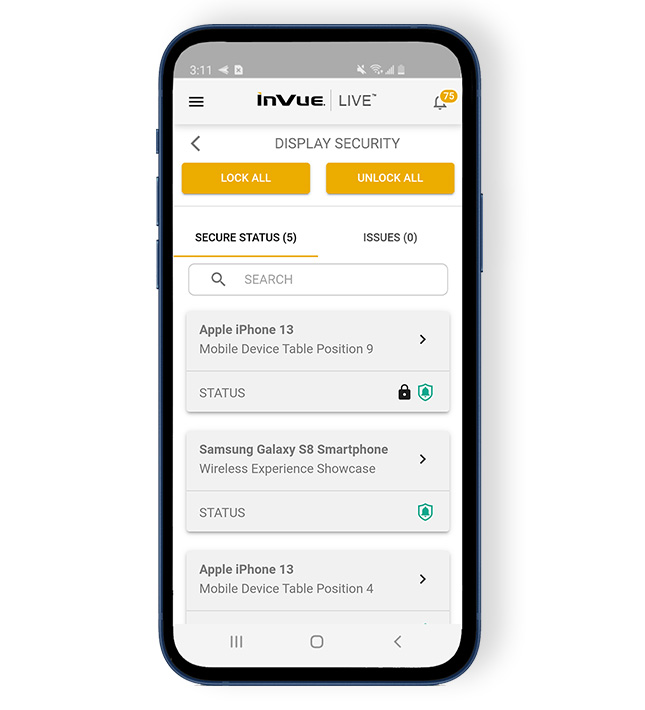

Cyber Weekend is both an in-store and online event, meaning retailers need to ensure their customer experience is seamless across all channels.

Top areas to focus on include:

- A mobile-first online experience

- Clear visibility of product levels to minimise out of stocks

- Sufficient staffing levels and mPOS to minimise time spent in the queue

- Frictionless click and collect (BOPIS) or home delivery

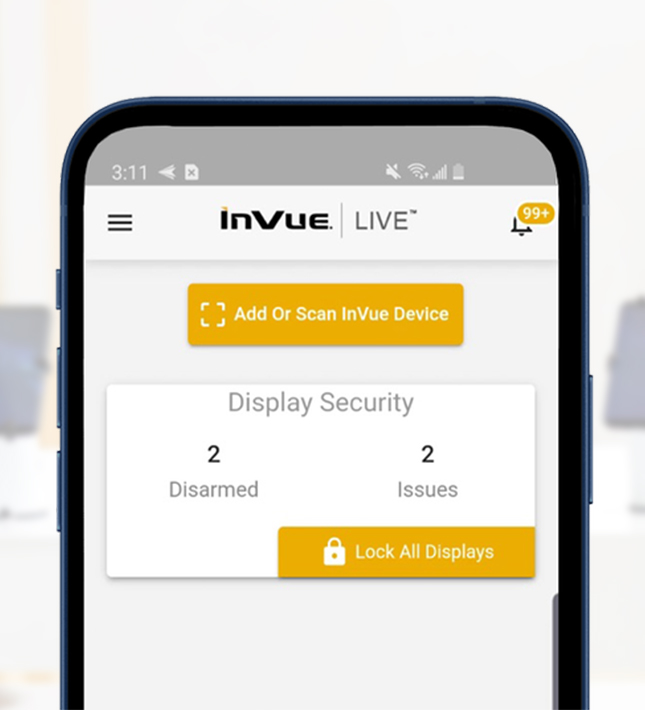

- Increased loss prevention strategies to mitigate shoplifting, fraud and employee theft

- Improved displays and merchandising to appeal to customers instore

The four-day sales event commences with Black Friday on November 26 and concludes on Cyber Monday on November 29.

You can find more insight into current spending intentions and retail here.