Within the space of weeks, online retail would become the new norm, malls would be almost off limits and lockdown would be added to our lexicon of words for the year.

But 18 months later, how much has really changed? Let’s look at how COVID changed the consumer and how that translates to the future of retail.

Digital adoption skyrocketed

One of the major trends of COVID was the rapid rate of digital adoption, and this played out in retail, the education sector and at work.

As McKinsey Research notes, a decade of digital adoption was covered in days, with people turning to technology for meetings, schooling, information and retail.

In terms of consumer behaviour, this saw customers turn to online shopping to have their needs met.

Australia Post reported in 2020 alone, online purchases grew 57 per cent year-on-year, with Australians spending a record $50.46 billion online.

In fact, online spending in 2020 accounted for 16.3 per cent of all retail, which, considering the rate of growth prior, was a figure that wasn’t expected to be reached until 2023.

Their data indicated four in every five Australian households made an online purchase in 2020, which equated to over 1.3 million more households purchasing in 2020 than in 2019.

And that trend hasn’t abated.

In July 2021, Australia Post found online spending had increased a further 26.9 per cent year on year for the 12 months to 31 July 2021.

Buying behaviour changed

One of the most fascinating trends to emerge from the pandemic was the types of products people were buying.

As restrictions increased and people were forced to stay home, attention turned to products like homewares, DIY, fitness and wellbeing.

KPMG found 81 per cent of consumers focused more on health and wellbeing during COVID than they would normally.

Meanwhile, the types of retailers enjoying bumper profits highlighted the shift in trends towards home products and office equipment.

Among the latest retailers to report a stellar sales year were Harvey Norman; Wesfarmers courtesy of a spike in profits for Bunnings, Officeworks, Kmart; and JB Hi-Fi.

Click n Collect became a mainstay

As retailers pivoted to adapt to COVID behaviours, Click n Collect became a mainstay.

But the reality is, the pandemic simply accelerated an emerging trend.

In 2019, the Commonwealth Bank noted 53 per cent of retailers offered online ordering with instore pick-up.

However, consumer demand for the service has spiked markedly since the beginning of the pandemic.

A further Commonwealth Bank report in May this year found that trend is likely to continue.

More than 80 per cent of the consumers who used click-and-collect services more often during the pandemic say they will continue to use them more than they did pre-pandemic.

Cashless proved king

Australia has traditionally been a swift adopter of new payment technology, including EFTPOS, digital wallets, and tap-n-go.

Last year, that trend accelerated rapidly with cash considered a risk in the spread of COVID-19.

That saw a spike in contactless payments with consumers opting to use the tap-n-go feature on their credit or debit cards, or alternatively the digital wallet on their mobile phone.

The FIS Global Payments report noted in 2020 Australians used less cash to make in-person payments, with credit cards, debit cards and mobile wallets proving the most popular payment options.

Looking ahead, they predict cash use will continue to decline across the Asia Pacific region, falling to just 2.1 per cent by 2024.

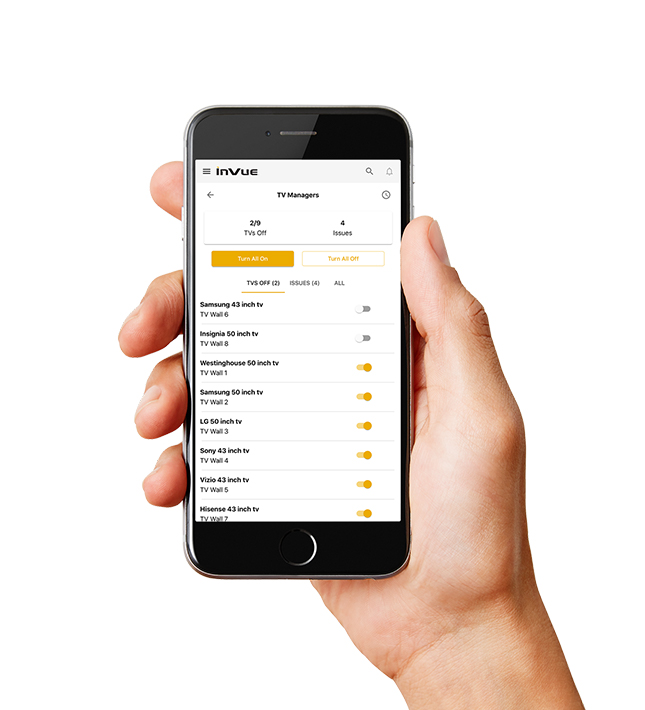

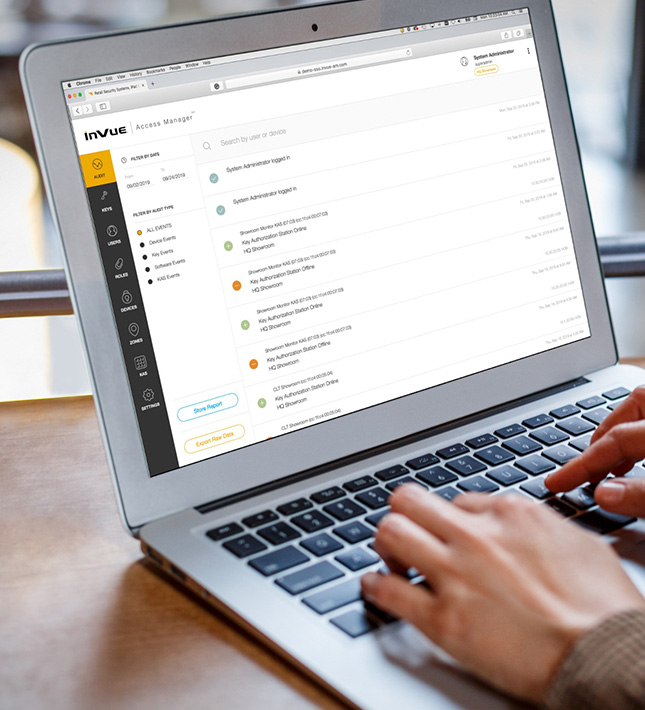

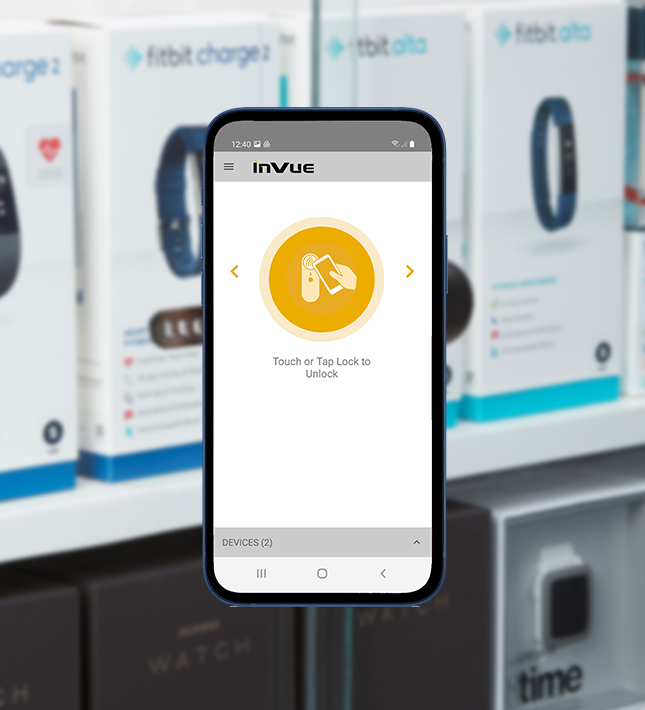

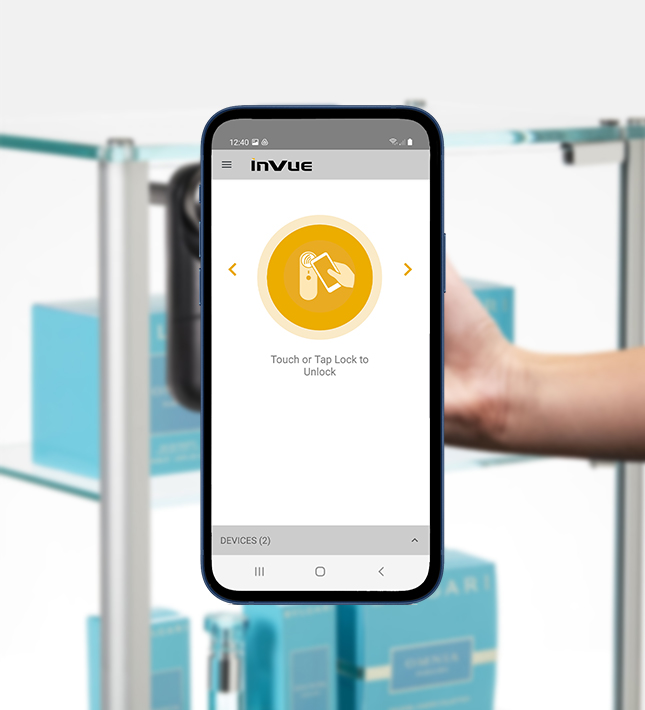

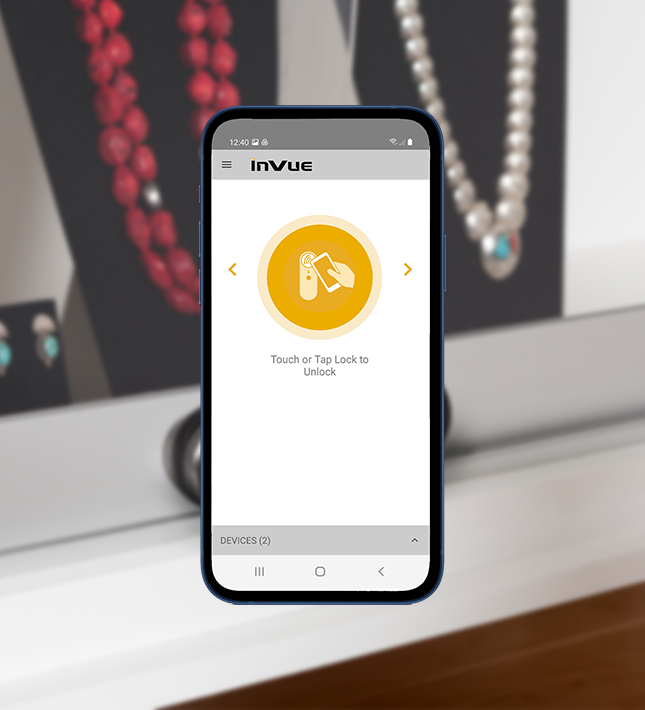

Meanwhile it also led to an increase in mobile Point of Sale (mPOS) transactions, which Statista predicts will continue to rise in the period ahead.

They note the value of mPOS transactions in Australia is set to reach $32.3 million in 2021, and increase at an annual growth rate of 28.74 per cent to reach about $88.8 million by 2025.

Consumers went local

According to the Commonwealth Bank, consumers appreciated the efforts of retailers throughout the pandemic, and have been keen to reward them as a result.

That’s seen a spike in buyer behaviour where the focus is shopping Australian and shopping local.

“One of the biggest changes in online shoppers’ activities during the pandemic was to increase the volume of purchases they made from online retailers located in Australia,” the most recent consumer insights report explained.

“Of the 49 per cent of consumers who migrated towards domestic online retailers, 52 per cent say they will continue to do so to the same degree in 2021.”

Meanwhile, with people confined to their own neighbourhoods, many consumers rediscovered local gems.

“According to the research, a net 5 per cent of consumers say they will be frequenting their local suburban shopping centres and neighbourhood stores more often in 2021 than they did pre-pandemic,” the report found.

The final word

COVID-19 changed our world in a host of ways, and retail became both an unsuspecting winner and loser as the result of altered consumer behaviour.

Although some things may revert to pre-pandemic habits once vaccinations increase and life returns to a new normal, other consumer changes are likely here to stay.

The retailers who embrace the altered omni-channel, digital and personalised expectation are the ones most likely to thrive in the period ahead.

For more information on technology to facilitate the changed customer expectation, see our mPOS solutions here.