Changing customer sentiment

McKinsey Research surveyed Australians regarding their sentiment in a post-Covid world.

The data revealed:

- 34 per cent of customers had switched stores in a bid to shop in an environment that was less crowded

- 19 per cent had switched to a store that they believed was cleaner

- 16 per cent had switched to retailers with better delivery or pickup options

Meanwhile:

- 33 per cent ranked cleaning and sanitisation as their biggest priority when shopping in-store

- 27 per cent were focused on physical distancing

- 12 per cent wanted to see masks and barriers

- 11 per cent looked for contactless purchasing

- 8 per cent wished to see clear store regulations, and

- 7 per cent viewed health checks as a priority

The rise of mPOS

Adoption of mobile Point of Sale has been steadily increasing over recent years, but COVID has accelerated this further.

In 2018, Juniper Research predicted mPOS transactions would triple to 87 billion by 2023, and that was before the onset of COVID-19.

Meanwhile, the push for contactless payments is contributing to the mPOS trend.

In March 2020, the World Health Organization recommended contactless payments as a way to reduce the virus spread. According to a survey of 17,000 people globally by Mastercard, that resulted in 46 per cent of people swapping out their ‘top of the wallet’ card for one which offered contactless payments.

“The majority of respondents (82 per cent) view contactless as the cleaner way to pay, while the speed of tap and pay is also seen as a benefit, enabling customers to get in and out of stores faster,” the survey noted.

Ultimately this has seen retailers and hospitality venues turn their attention to mPOS, as they seek portable, innovative and contactless ways to meet the new expectations of consumers as they navigate a post-Covid landscape.

So how exactly can mPOS assist?

Curb the crowd, cut the queue

One of the key attributes of mPOS is its ability to cut time spent in the queue, which in turn serves to reduce crowding in store.

With the right set-up, mPOS is truly mobile, meaning sales associates can take the actual register to the consumer, with a payment processor attached.

This allows for swift transactions and reduces the need for queuing, with sales processed immediately, anywhere on the shop floor.

Scalable

One of the key attributes of mPOS is its ability to cut time spent in the queue, which in turn serves to reduce crowding in store.

With the right set-up, mPOS is truly mobile, meaning sales associates can take the actual register to the consumer, with a payment processor attached.

This allows for swift transactions and reduces the need for queuing, with sales processed immediately, anywhere on the shop floor.

Also helping to reduce crowding and queuing is the fact mPOS is scalable. Utilising only a tablet and payment processor as a bare minimum, it allows retailers to affordably implement multiple points of sale.

In other words, when one register is busy, another can be quickly opened, further streamlining the checkout process and reducing time spent waiting instore to make a transaction.

Click and collect

As consumers sought to expedite the purchasing process and avoid shopping in person, click and collect or buy online pick-up in-store (BOPIS) became one of the major trends of 2020.

Again, this is where mPOS became vital, allowing retailers to instantly reconcile online orders with stock instore and fulfill requests on behalf of their customers.

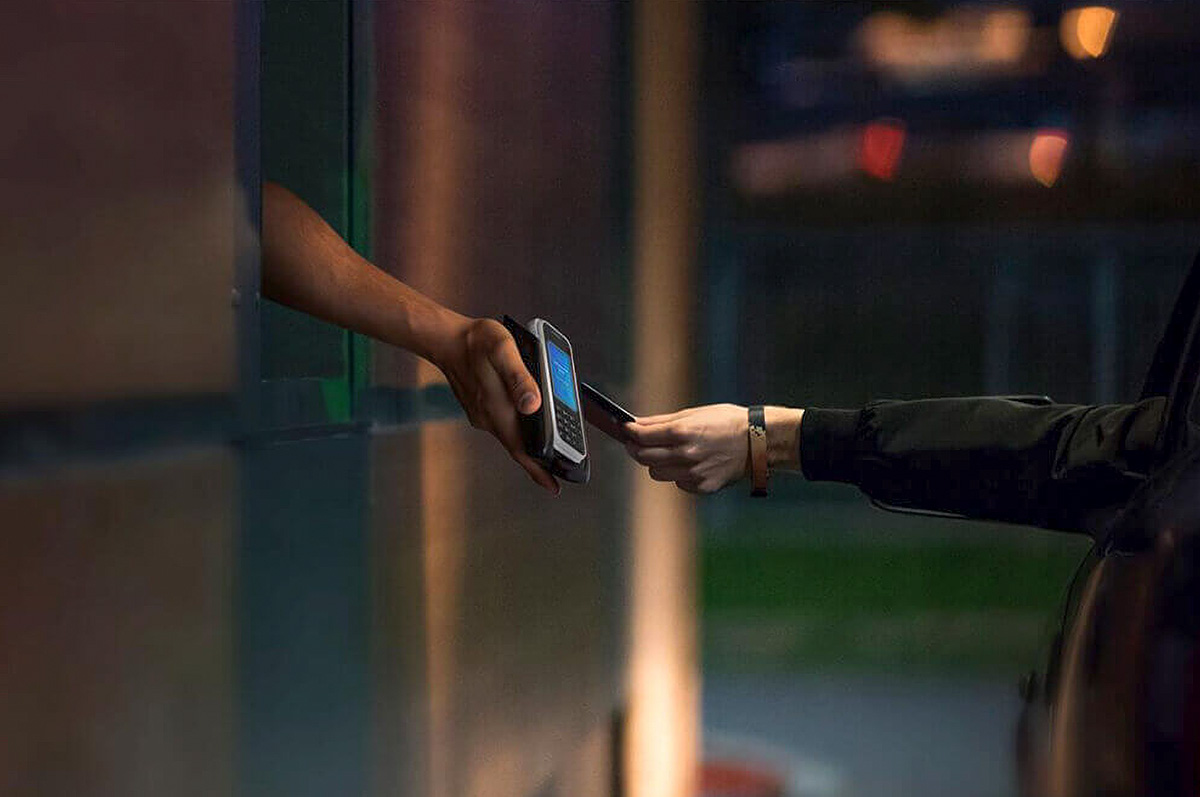

More importantly, it allowed POS technology to be taken to the car park or curb-side, facilitating contactless pickup.

The technology enabled retailers to quickly pivot and adapt, with the register and a history of payments and orders in the hands of mobile sales associates.

Contactless

Last but not least, truly mobile mPOS facilitates contactless payments by incorporating card processors into a register that can be taken anywhere.

These registers allow consumers to pay for products via near field technology, to process transactions without entering a card or touching a pin-pad or alternatively, to order items from the comfort of their homes, and to pick them up without even speaking to a sales associate in person.

mPOS helps retailers bridge the gap between the online and real-world while offering a payment method that one-tenth of consumers now favour.

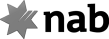

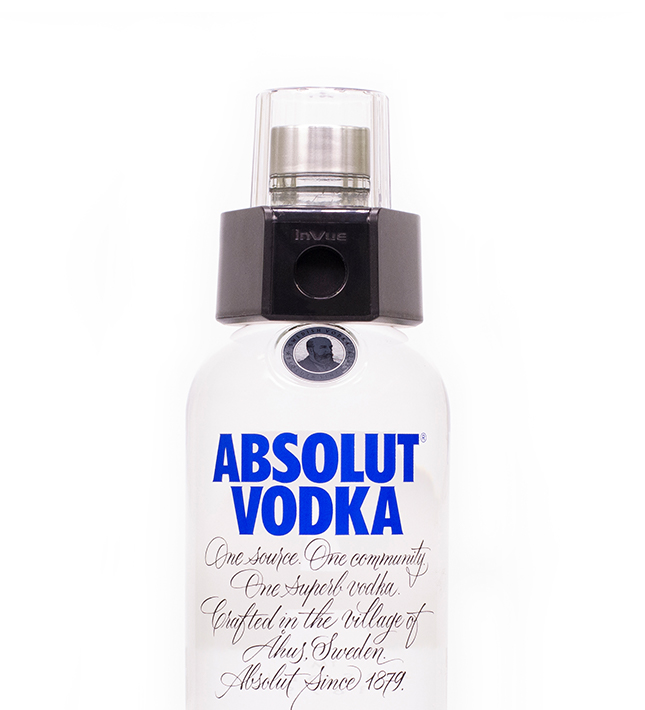

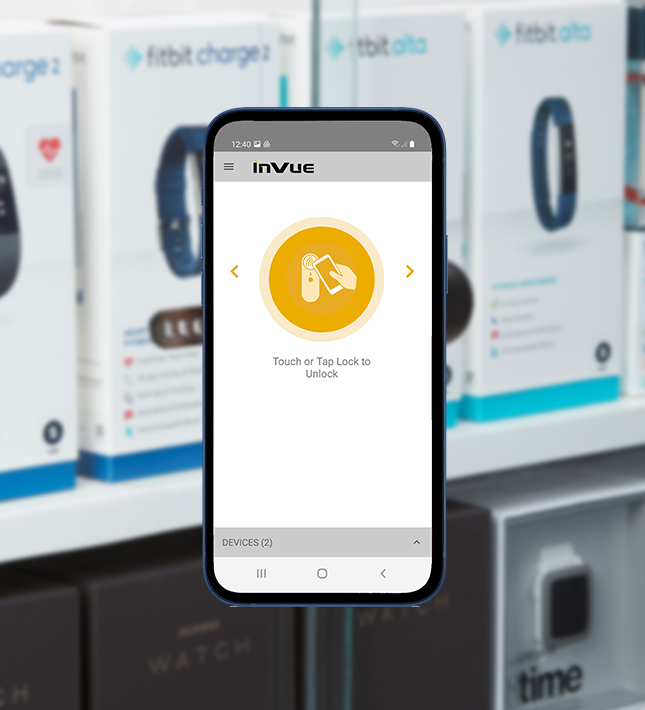

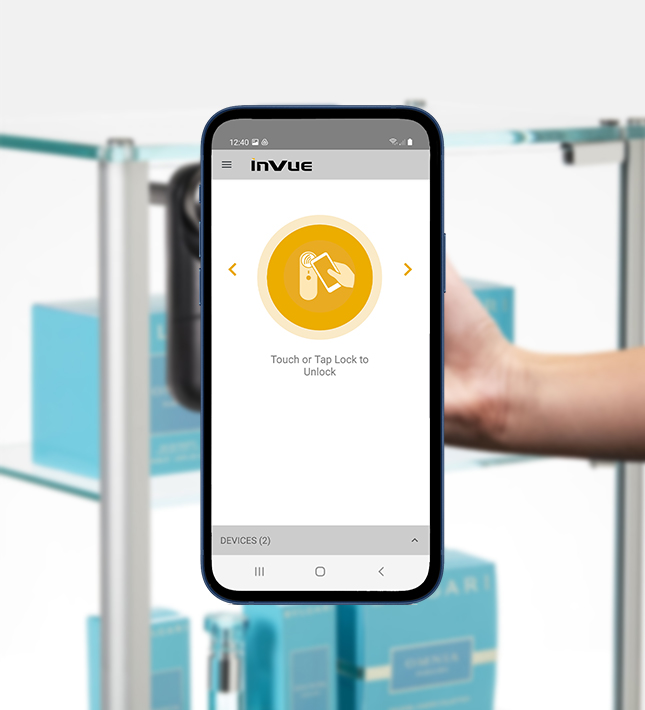

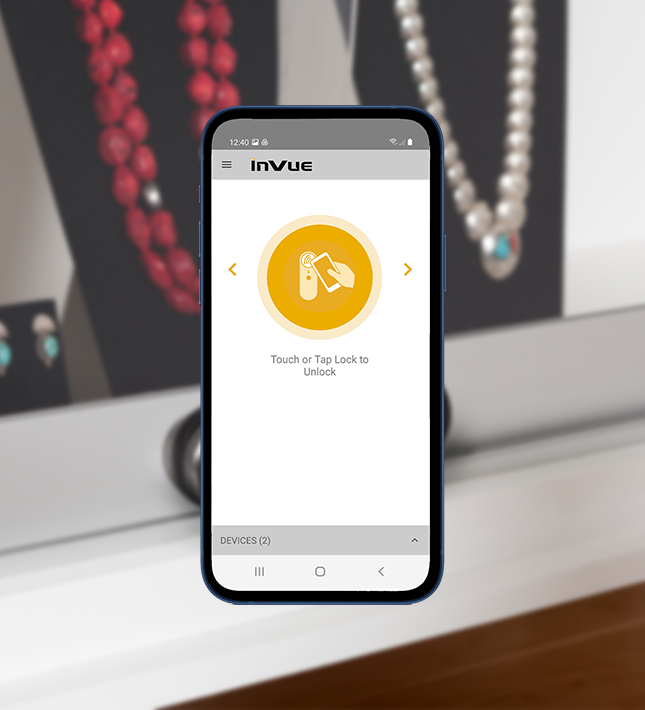

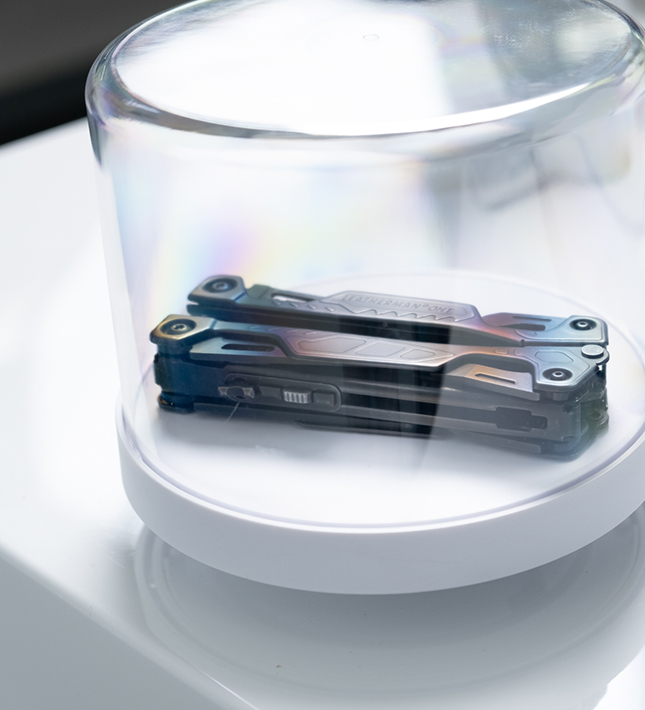

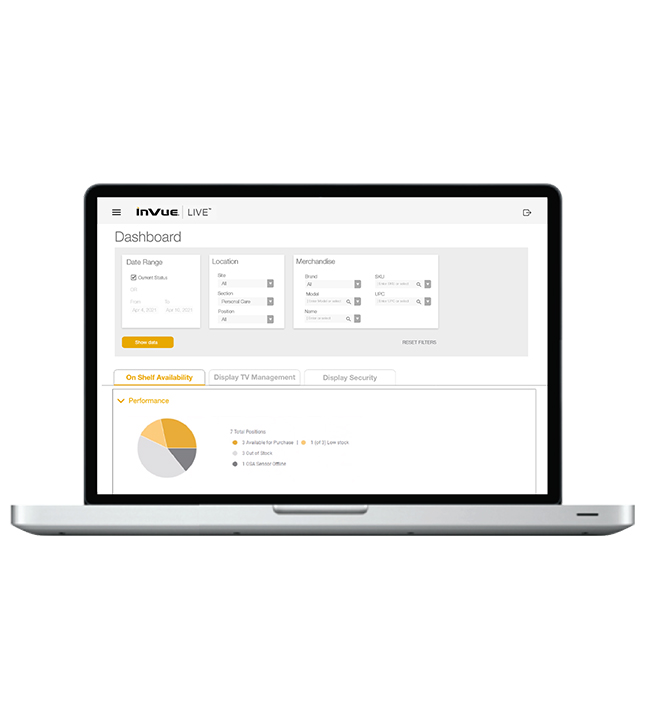

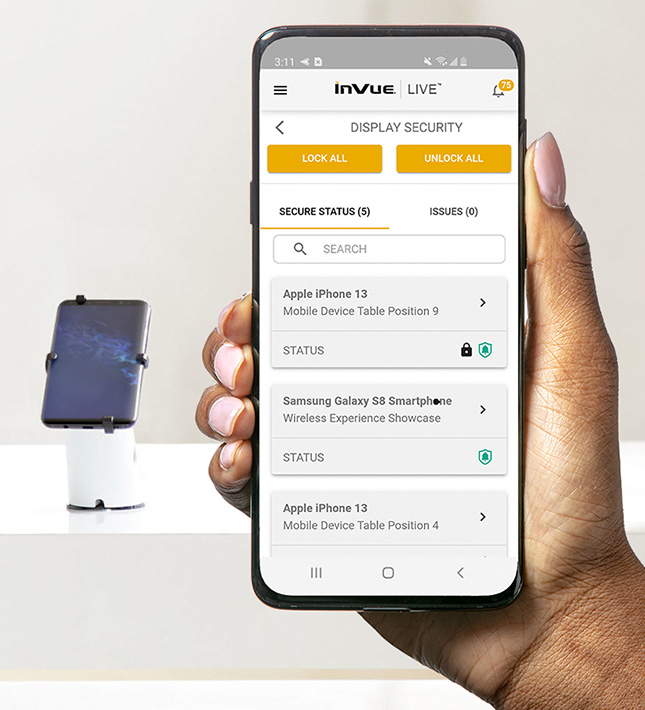

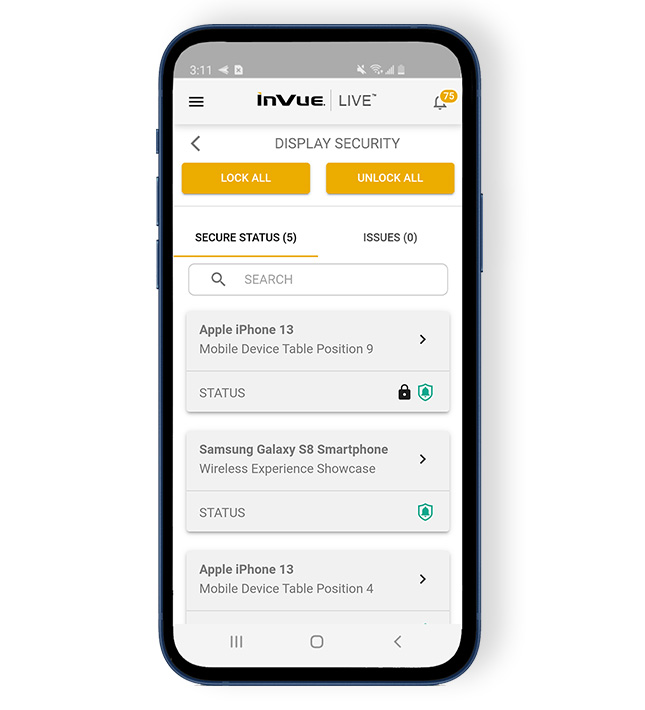

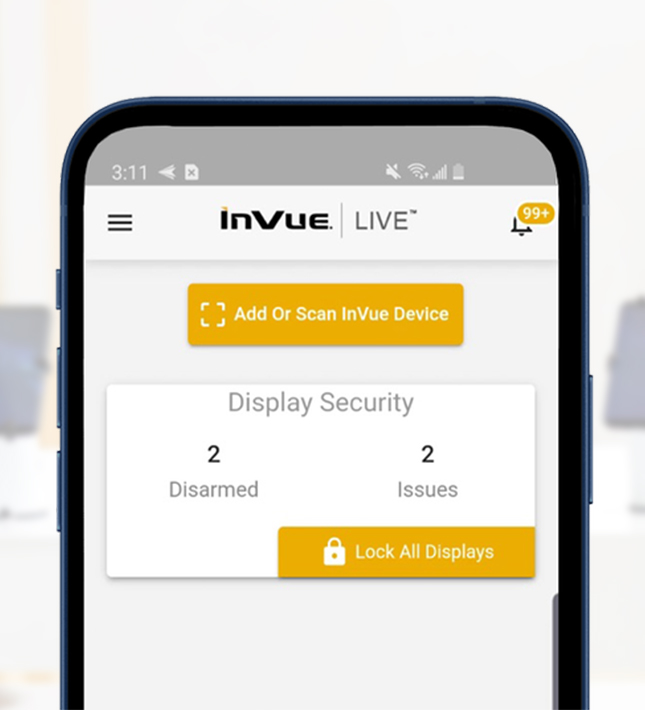

Introducing NE360

InVue NE360 mPOS Terminal Centre is the most flexible mPOS solution on the market. Retailers can use it with any tablet, smart device, or any mobile payment terminal with any operating system (OS).

Ultimately, it allows retailers the freedom to set up the mPOS ecosystem they prefer, while accommodating the changing consumer sentiment of a post-Covid landscape.

You can learn more about NE360 and the groundbreaking mPOS solution it offers retailers here