The trend away from cash

Australia has traditionally been a swift adopter of new payment technology, including EFTPOS, digital wallets, and tap-n-go.

Last year, that trend accelerated rapidly with cash considered a risk in the spread of Covid-19.

That saw a spike in contactless payments with consumers opting to use the tap-n-go feature on their credit or debit cards, or alternatively the digital wallet on their mobile phone.

The FIS Global Payments report notes in 2020 Australians used less cash to make in-person payments, with credit cards, debit cards and mobile wallets proving the most popular payment options.

Looking ahead, they predict cash use will continue to decline across the Asia Pacific region, falling to just 2.1 per cent by 2024.

mPOS becomes essential

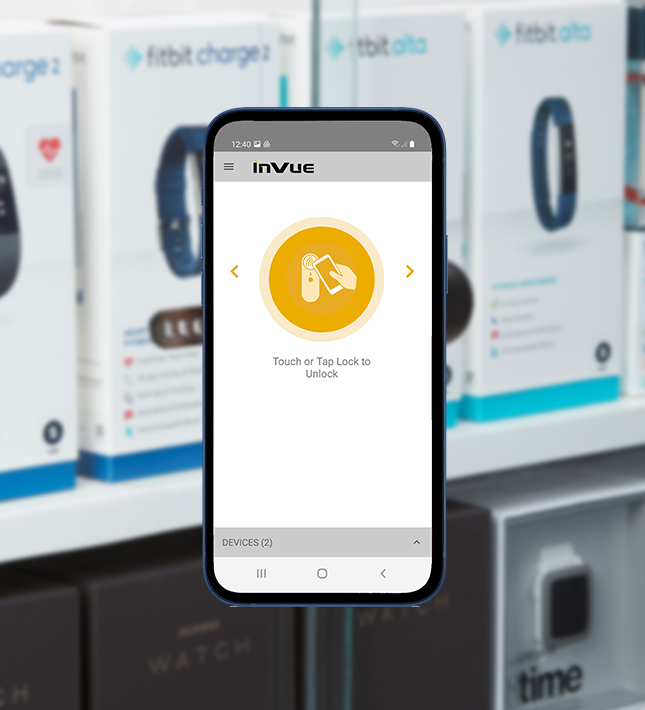

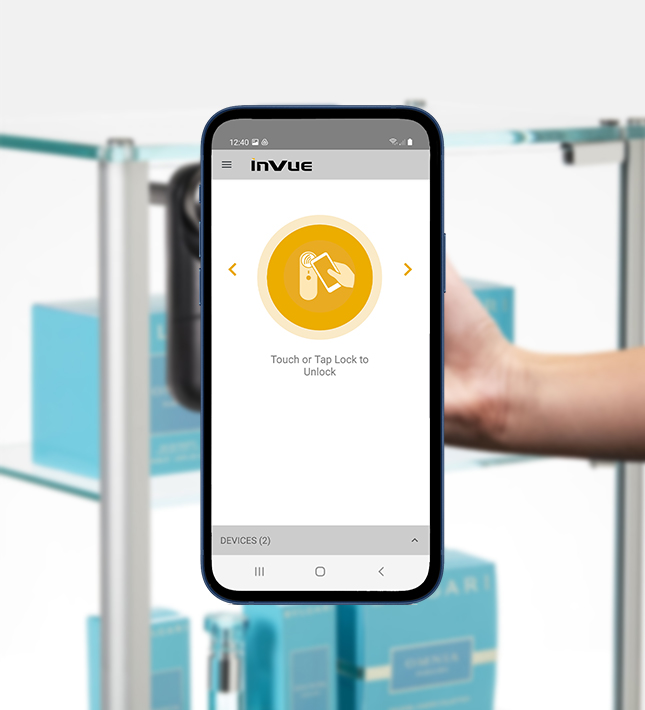

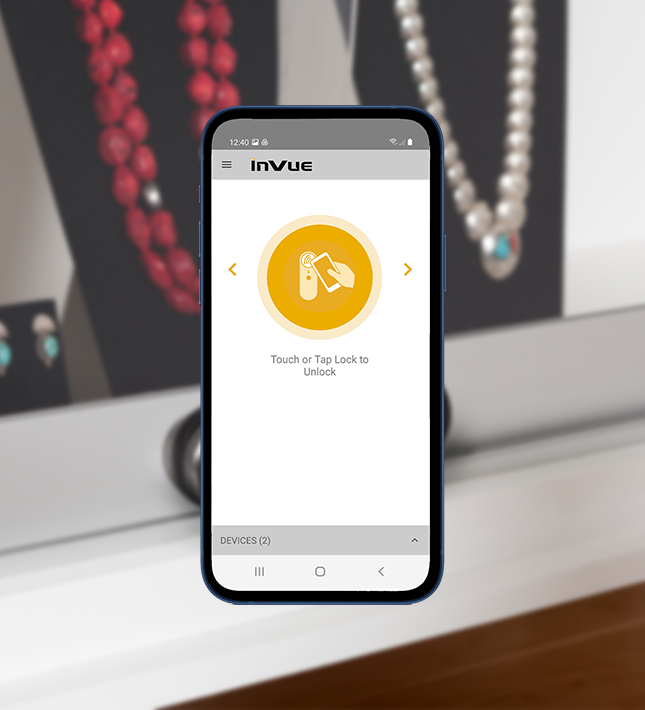

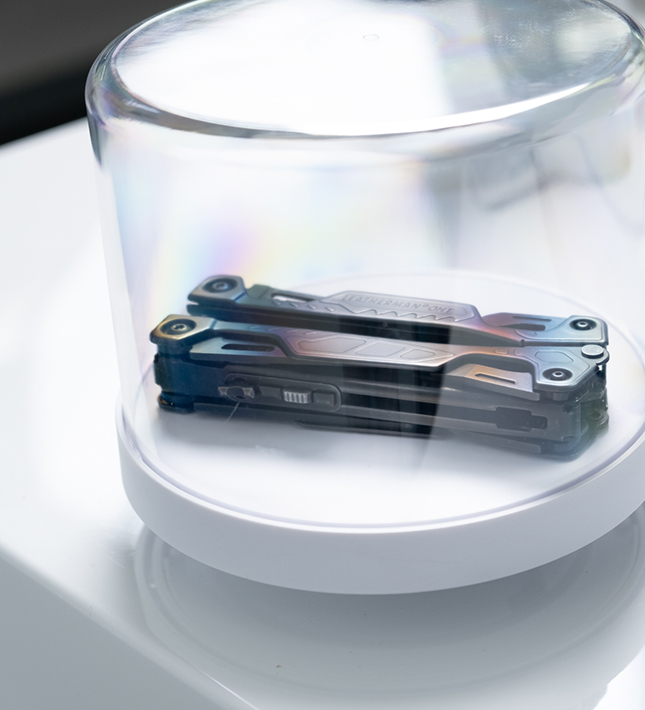

Featured product: InVue NE360T Tablet solution

With a near-cashless economy looming large on the horizon, bricks and mortar retailers are turning their attention to the convenient payment options offered by mobile Point of Sale.

Now more affordable than ever, the system sees the traditional Point of Sale offered via a handheld device such as a tablet with a payment processor attached.

Convenient for both the retail outlet and the consumer, mPOS allows sales to be processed on the retail floor, cutting time spent in the queue, while offering an improved customer experience.

As a result, Statista forecasts:

• Mobile POS Payments will reach AU$32,944 million in 2021.

• The average transaction value per user in the Mobile POS Payments segment is expected to amount to AU$8,473.6 in 2021.

• Transaction value is expected to show an annual growth rate (CAGR 2021-2025) of 28.24 per cent resulting in a projected total amount of AU$89,101 million by 2025.

• In the Mobile POS Payments segment, the number of users is expected to amount to 6.2 million users by 2025.

It’s all about convenience

Featured products: IR Package Wrap and InVue NE360H Handheld Solution

As a recent report by Retail Touchpoints notes, the shift to mPOS is all about convenience, and at present that convenience involves contactless payments.

“The POS is the customer’s last experience on any given trip, so any friction or delays felt here will be magnified — and implementing the right payment procedures can increase comfort and speed up the checkout process,” they explain.

They also note, however, what constitutes convenience can quickly change.

“Something to keep in mind when perfecting a POS strategy is that the definition of convenience is a moving target.

“While this always comes down to helping shoppers check out as quickly and easily as possible, their expectations are always evolving alongside payment providers’ capabilities. Right now, this means contactless, but preferences can and will change in the future,” they state.

“Retailers need to keep their fingers on the pulse of not just their customers, but the payments industry as a whole.

“Being ready to implement the latest and most efficient payment options ahead of your competitors can simultaneously drive convenience and ensure that the early adopters among your customers are getting the exact experience they want.”

Meanwhile, their research indicates both shoppers and retailers are rising to the mPOS challenge.

Some mPOS stats

The shift to contactless, the push for convenience and the blurring of the lines between the online and real-world retail experience mean customers now expect more options for how they pay at the Point of Sale.

Retail Touchpoints notes:

• More than four out of five (85 per cent) of shoppers expect retailers to have digital payment options available at physical POS.

• The most popular options include: Tapping a credit or debit card (62 per cent), mobile payment apps (41 per cent), digital wallets (37 per cent).

As a result, retailers are focusing their efforts on a seamless mPOS experience.

Their research also found:

• 44 per cent of small businesses believe contactless or other types of mobile payment acceptance are critical areas of investment to meet consumer needs; and

• 41 per cent believe that the ability to accept payments via mobile device or untethered to a POS is a critical area of investment.

Introducing the NE360

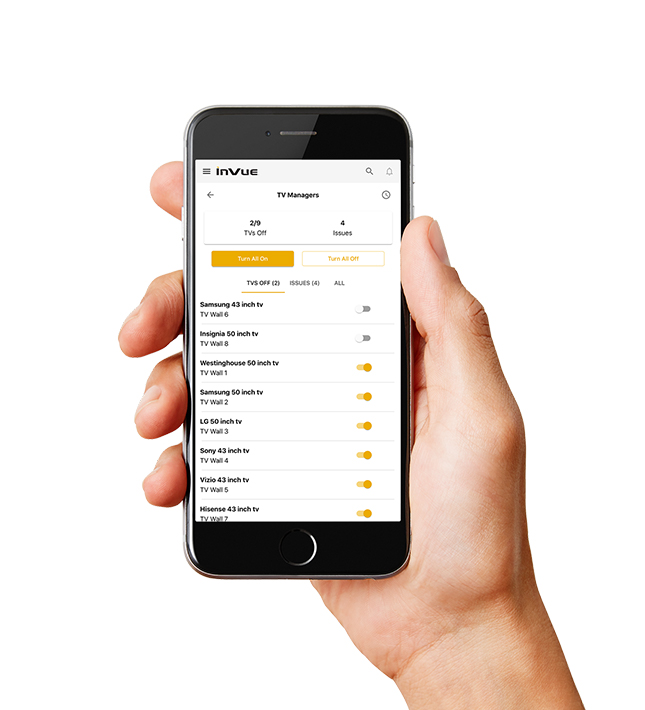

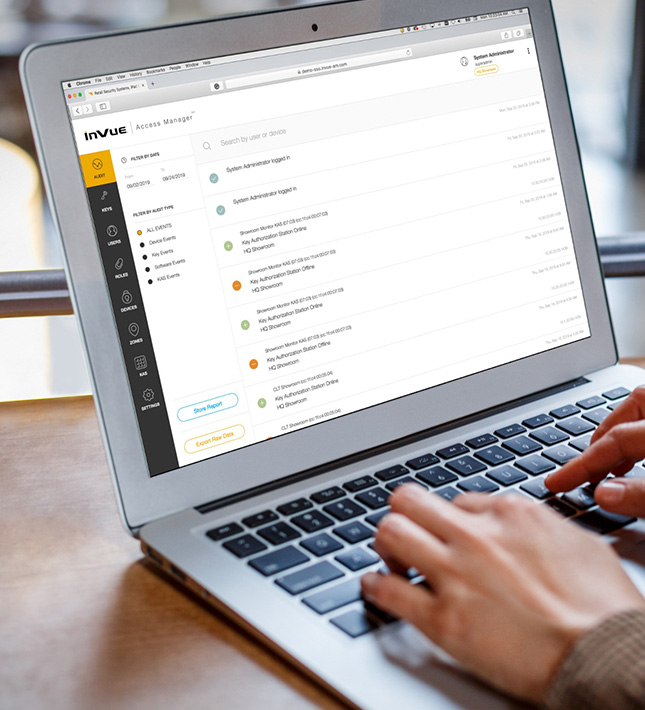

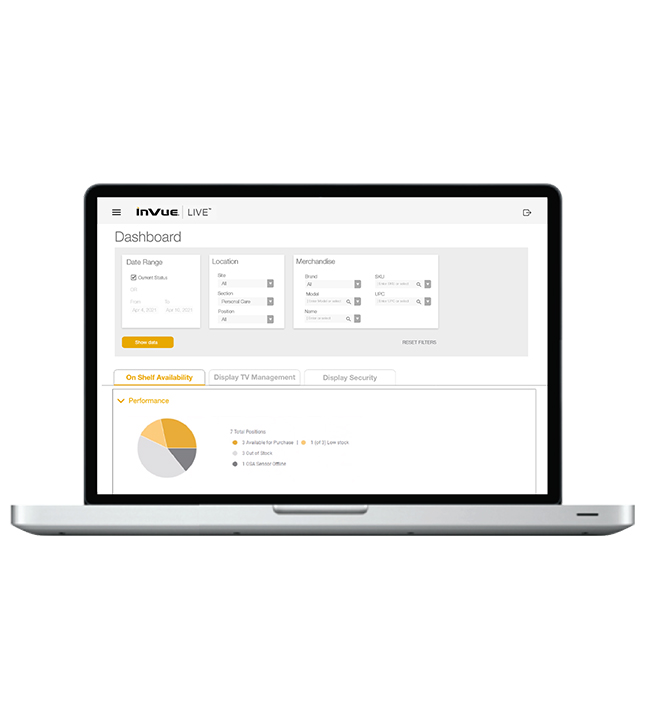

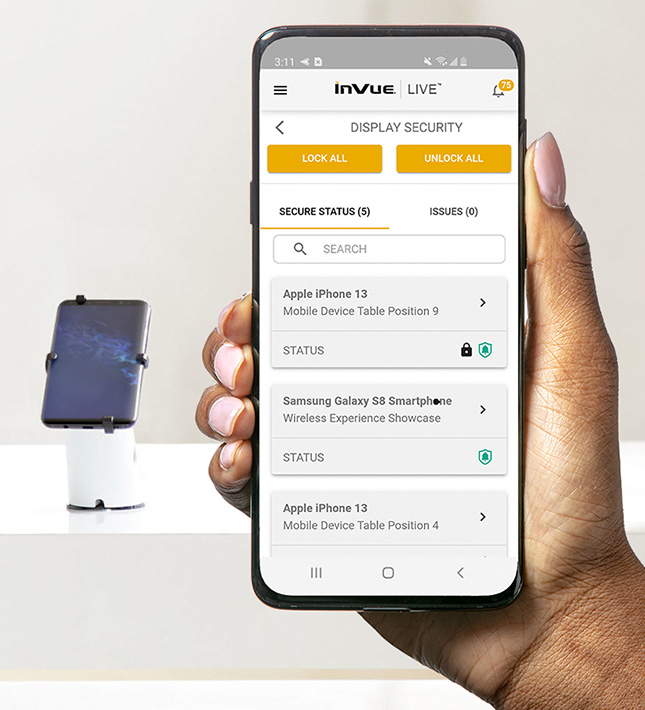

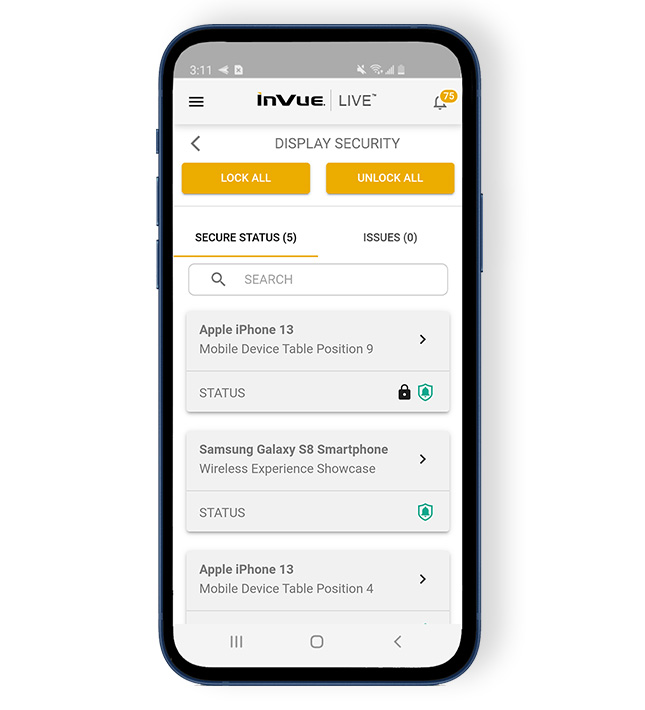

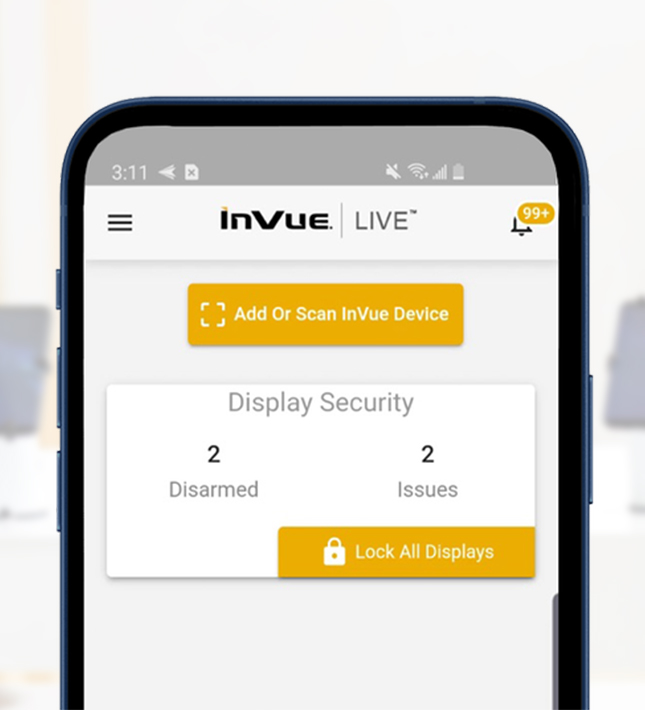

InVue NE360 mPOS Terminal Centre is the most flexible mPOS solution on the market. Retailers can use it with any tablet, smart device, or any mobile payment terminal with any operating system (OS).

Ultimately, it allows retailers the freedom to set up the mPOS ecosystem they prefer, while accommodating the changing consumer sentiment of the modern retail landscape.

You can read more about the benefits of mPOS here, or learn more about NE360 and the simple mPOS solution it offers retailers here.